–>

“The pandemic was a consequential moment for e-commerce, Vivek Pandya, a lead analyst at Adobe Digital Insights, stated this week in connection with a report from the data analytics firm, which expects U.S. e-commerce spending to reach $1 trillion this year, up from an estimated $870.8 billion in 2021. Not only did COVID-19 “accelerate e-commerce growth by nearly two years, but it also impacted the types of goods consumers are willing to buy online,” per Adobe. Among those types of goods are, of course, the offerings of luxury goods groups, marking a notable shift among luxury sellers, which have traditionally opted away from e-commerce, and consumers, alike.

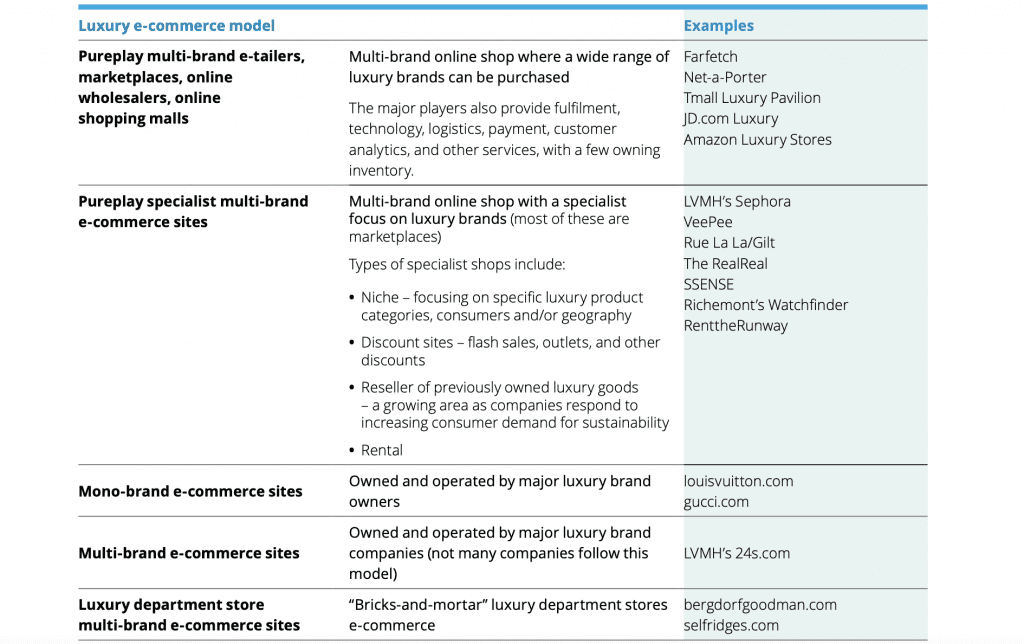

“For much of this century, many owners of the leading luxury brands refused to sell online, relying on their physical networks of their own (mainly mono-brand) boutiques and multi-brand third-party retailers,” Deloitte stated in its 2021 Global Powers of Luxury Goods report, pointing to the desire to “retain control over the defining elements of the luxury identity of their brands – exclusivity, craftsmanship and authenticity, customer service and delivery, and consistent luxury consumer experience and messaging,” as well as the “lack of capability to deliver these elements online—both in skills and experience, and in the significant ongoing investment required,” as among a couple of the key reasons for luxury brands’ long-time reliance on models that consisted largely of brick-and-mortar sales.

The onset and enduring impacts of the pandemic paired with the increasing desire for luxury brands to cater to younger consumers, namely, millennials and Gen-Zs, demographics, which are inherently more comfortable purchasing products online than their older counterparts, have seen companies with existing e-commerce and digital marketing capability “respond quickly to pivot to online solutions,” according to Deloitte. The consultancy stated that beginning in 2020, luxury e-commerce “went past the tipping point and became a vital part of the omnichannel distribution strategy for global luxury players” – even if the move to embrace digital is a difficult and resource-intensive one that calls for “sophisticated e-commerce ecosystems” and strategies, localization, etc.

While a few leading luxury companies (notably Rolex and Chanel) “still believe that for some of their categories the final client purchasing experience should always be in a physical store,” luxury brands have made efforts on the e-commerce front and seen significant growth. One need not look further than groups’ FY 2021 reports, the most recent of which (from Prada) was released this week, for indications of this.

The Year in E-Com: Prada, Kering, LVMH & Hermès

In its FY 2021 report, Prada Group revealed that it its online sales were “five times higher” in FY 2021 compared to FY19 and up 61 percent compared to FY20. Online sales now account for 7 percent of its total retail sales, and the group says that it expects to boost investments in its digital footprint in order to enhance consumers’ experience. (A year earlier, Prada stated that the COVID-19 pandemic “accelerated the digital evolution, reinforcing Prada Group’s omnichannel strategy,” prompting e-commerce sales to surge by 200 percent.)

Elsewhere in the market, Kering reported its revenues last month, reflecting on the luxury industry’s embrace of digital and stating that e-commerce broadly was “expected once again to be the fastest-growing distribution channel in 2021 (up 27 percent compared to 2020 but up 89 percent versus 2019).” The proportion of industry revenue generated by online sales – estimated at 12 percent in 2019 – may have reached 22 percent in 2021, per Kering, which noted that “websites directly managed by brands (Brand.com) and e‐concessions (concessions within e-commerce sites) are likely to have seen particularly strong growth, as luxury houses seek to gain greater, or indeed exclusive, control over their distribution.”

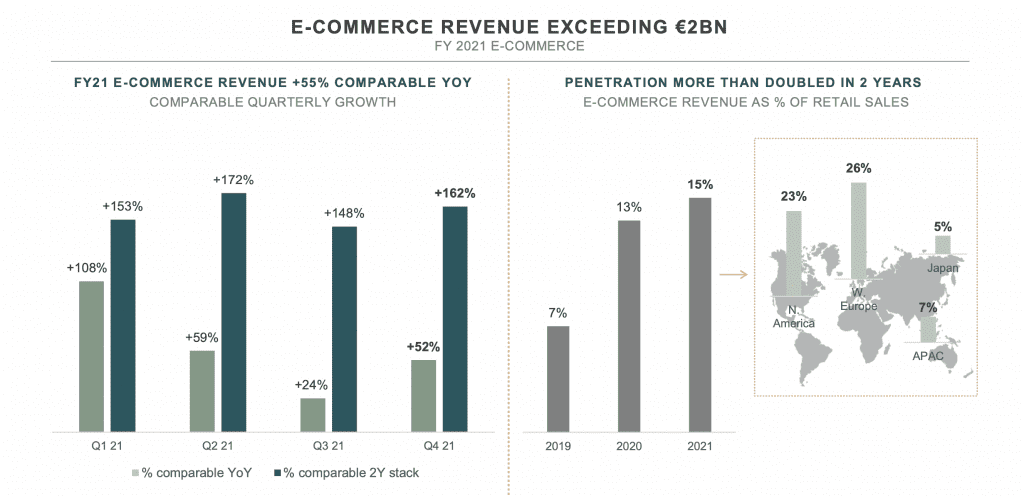

In terms of its own e-commerce operations, Kering revealed that as a group, its e-commerce sales topped 2 billion euros in 2021, up 55 percent from the year prior. “The online channel’s penetration rate doubled in two years, and it now accounts for 15 percent of total sales in the retail network,” the Gucci, Balenciaga, Bottega Veneta, and Saint Laurent owner stated, with e-commerce accounting for 23 percent of retail sales in North America, and e-commerce sales tripling compared to 2019. Meanwhile, in Western Europe e-commerce sales accounted for 26 percent of total retail sales, followed by APAC (7 percent) and Japan (5 percent).

Looking at individual brands, Kering confirmed that Saint Laurent, which generated 2.52 billion euros ($2.86 billion) in revenue for the year, saw e-commerce sales “triple compared to 2019.” At Gucci, whose sales rose to 9.73 billion euros ($11.07 billion), e-commerce accounted for almost 16 percent of total retail revenue during the year. “Online sales growth was therefore once again very buoyant, up 55.1 percent relative to 2020,” per Kering, and up 163 percent compared to 2019.

And in a nod to its overarching “focus” on its brand.com sites, Kering stated that Bottega Veneta’s e-commerce business, where sales were four times their 2019 level, “was boosted by the move to bring in-house operations that were previously managed under a joint venture with Yoox.” (Following its move to first internalize e-commerce activities at Gucci, Kering has finalized its other brands in FY21.)

Going forward, Kering asserted that is “investing proactively to develop cross-business growth platforms in the areas of e-commerce, omnichannel distribution, logistics and technological infrastructure, digital expertise and innovative tools.” And as Kering management stated in an earnings call in February, as highlighted by Bernstein, its “low e-commerce penetration in Asia and Japan shows great potential – everything there is done through e-concessions,” such as through Alibaba’s Tmall.

While LVMH provided a bit less insight into its e-commerce operations in its annual report in January, the industry’s largest group did confirm “continued strong growth of online sales alongside gradual return of customers in stores,” and its aim to “pursue further digitalization of our Maisons to enrich customers’ experience online and in stores.” In a nod to the importance of brand.com operations, LVMH states that it made “the choice … to keep [its brands’] distribution highly selective, limit promotional offers and develop online sales through their own websites” in order to “preserve their exceptional image – a key element of their lasting appeal.”

In terms of individual brands, aside from citing success of e-commerce sales for Sephora (which boasted “continued momentum” online, as it “scales up its digital strategy”) and brands within its beauty/fragrance division, LVMH revealed that Loewe “had a record year,” with “online sales growing significantly.” At the same time, LVMH states that “2021 was a year of new energy for Marc Jacobs, with strong growth in the United States and a highly impressive surge in online sales.”

Based on the language of its reports, LVMH’s efforts on the digital front – at least when it comes to its Fashion & Leather Goods brands – appear to be more focused on connecting with consumers and providing them with “high quality” and “compelling digital experiences” first, suggesting that it is still holding on to a preference for in-store sales to some extent, even if its e-commerce transactions are rising.

Finally, Hermès revealed that for FY 2021, it “continued to selectively develop its distribution network and online sales increased worldwide, with the rollout of new services and sustained growth in traffic.” Focusing on omnichannel development, management for Hermes confirmed that e-commerce continues to be a strong performer worldwide, particularly in attracting new customers to the brand. 78 percent of online sales in FY2021 were made by new customers, per Hermès, which does not see online sales acting to cannibalize in-store sales. Hermès asserted that in 2021, digital sales endured despite the reopening of physical stores.

Looking Ahead

Rising e-commerce sales for these groups and their increased emphasis on digital comes consumers proved increasingly willing to purchase these types of products online in 2021, despite consumers traditionally preferring to engage in luxury goods purchasing in-store. “While luxury shopping is very much still an in-person activity,” eMarketer found that as of January 2022, 2 in 5 U.S. adults who had bought luxury items in the past year had done so online.

This consumption trend is expected to continue, with Bain & Co. projecting that as much as one-third of all personal luxury purchases will take place digitally by 2025, putting the impetus on brands, even the likes of Rolex and Chanel, to engage in this space in at least some capacity.

You must be logged in to post a comment.