Successfully shifting from fossil fuels to full electrification

is a challenging enough objective for the automotive industry to

wrestle with during the decade ahead. The fact that the 2020s began

with a pandemic has only served to accelerate the need for industry

transformation, as the monumental impact of COVID-19 brought many

more disruptive macroeconomic issues to the fore.

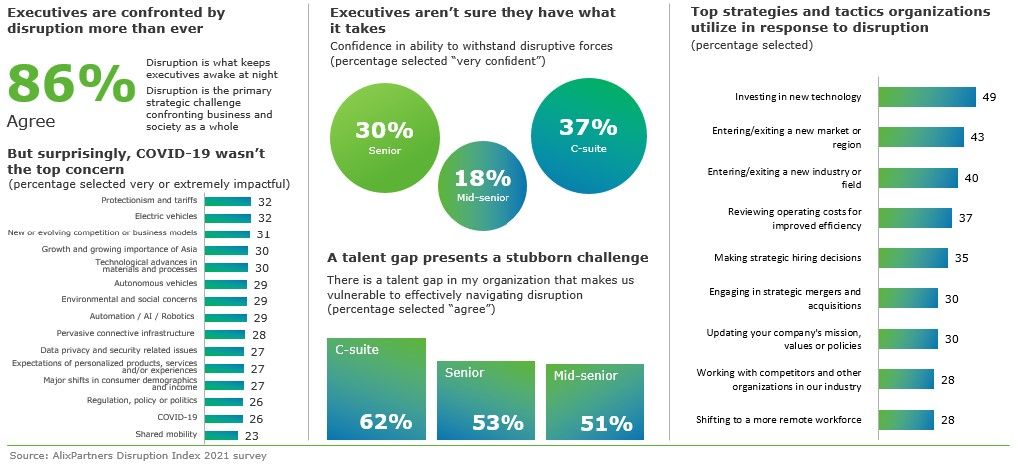

This year’s AlixPartners Disruption Index reports

that COVID-19 features low down the list of top concerns for

automotive executives, but there is little doubt that the events of

2020 have magnified the intensity of the other trials ahead.

Indeed, respondents in the industry display confidence levels some

way below the all-industry global average when it comes to their

businesses’ ability to withstand disruptive forces, with less

than a third reporting high confidence in this area.

We were told that protectionism and tariffs, electric vehicles,

and new or evolving competition or business models are the top

three issues keeping executives awake at night. It is a trio of

intrinsically intertwined challenges, all present before COVID-19

struck, but since supercharged from the events of the past 16

months.

Supplier shortages and shifting consumer preferences

Showroom shutdowns and a drop in demand presented automakers

with the headache of accurately anticipating the timing and level

of industry uptick. Further, manufacturing plants were brought to a

standstill at times, as a worldwide semiconductor shortage set in,

stifling OEMs’ ability to return to full production during the

second half of last year. As forecast in our 2021 Global Automotive Outlook, the cost of

this stuttering restart, specific to semiconductor availability, is

expected to cost automakers around the world nearly four million

light vehicles of lost production, worth $110bn.

These direct economic impacts are stark, at a time where the

evolution to a cleaner automotive future – and the huge

levels of enabling investment required – is dominating the

long-term roadmaps for every player in the industry, governments,

and consumers.

Changes to consumer behaviour because of the pandemic, including

increased financial concern and heightened environmental awareness,

will continue to adapt the automotive landscape in terms of length

of vehicle ownership and number of vehicles owned per household.

This appears to be of particular concern in China, where 50% of

respondents identified changing consumer demographics as being very

or extremely impactful, versus 27% globally. The online second hand car sales market is also

booming, and as cost and infrastructure barriers around

electric vehicle adoption persist and the uptake of alternative

emerging micro-mobility models increases, it’s clear that there

is yet more disruption in the market for OEMs to contend with

beyond COVID.

The need to deliver on technology – and talent

Disruption Index respondents cited investment in new technology

as the top strategy to counter disruption. With all roads leading

to electric in the future, this may come as no surprise, but

adjacent to this is a firm focus on better strategic hiring

decisions. Our study told us that 62% of automotive C-suite

respondents agree that there is a talent gap in their organisation

that makes them vulnerable to effectively navigating

disruption.

As traditional manufacturing and technology continue to converge

in automotive, digital and tech skillsets are becoming increasingly

desirable to catalyse and effectively manage transformation

efforts. However, all industries are now driven by a digital-first

mentality and the battle for the top talent will only intensify

over time.

Perhaps this eye on where talent will need to over-index in the

future is why 48% of respondents expressed concern over job

security – most acutely observed in Japan at 77%. Long

periods of enforced human absence (or much reduced) from

manufacturing plants due to COVID restrictions have seen an

acceleration in integrating artificial intelligence equipment that

increases efficiency and effectiveness during production, also

carrying employment implications.

Suppliers will come under increasing pressure to adapt under, in

some cases, the existential threat of an electric future, where

powertrain component complexity drops dramatically and electrical

operability and connectivity needs continue to rise. COVID-19 has

highlighted that any fragilities in supply chains can have

catastrophic consequences, and OEMs will do as much as they can to

develop strategic alliances to shore this up for the future,

strengthening purchasing power and aligning with the optimal

network of innovative partners who can help them deliver on the

bold electric visions they have set out.

Ambitious targets require boldness in transformation

Global industry sales data suggests a strong post-pandemic

recovery to date, spurred on by a positive macroeconomic outlook,

but a return to pre-pandemic volumes is likely to be at least four

years out. The need to maintain strong revenues now to fuel

investment in electric means the race is already on to emerge as a

new-world winner when government EV targets for 2030 are on the

immediate horizon and OEMs’ individual targets for electric

propulsion share are being counted.

As consumer preferences continue to shift, the prize is immense

for developing the right product at the right price that can also

deliver healthy profitability after such heavy up-front

investment.

In times of such intense disruption, the need for transformation

is inevitable. The automotive market leaders that emerge in the

all-electric world will undoubtedly have displayed the agility,

innovation and speed to action to harness the huge opportunity that

now exists.

The content of this article is intended to provide a general

guide to the subject matter. Specialist advice should be sought

about your specific circumstances.