Deep learning provides several benefits to the insurance industry by quickly assessing claims, verifying documents, enhancing customer experience and detecting fraud.

From processing claims to enhancing customer experience, deep learning in insurance offers umpteen opportunities that can benefit the industry.

What is Deep Learning?

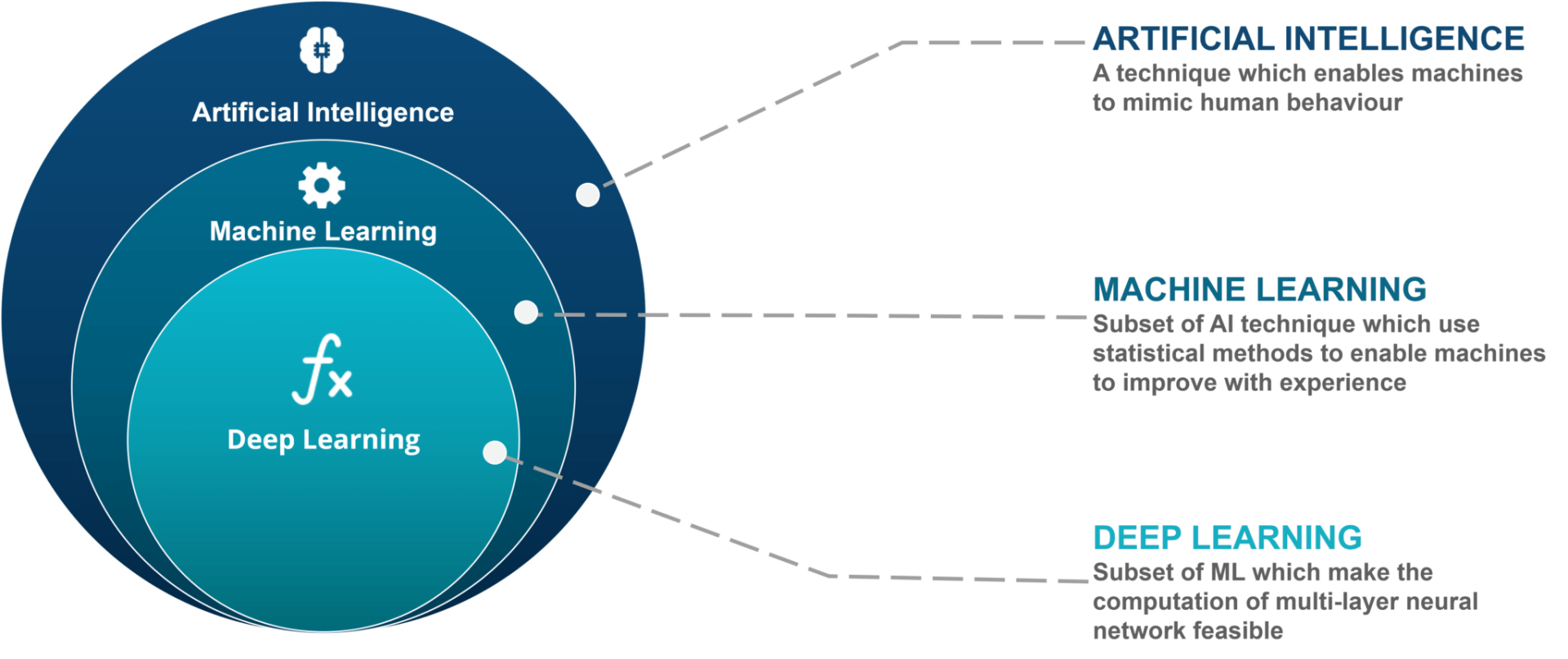

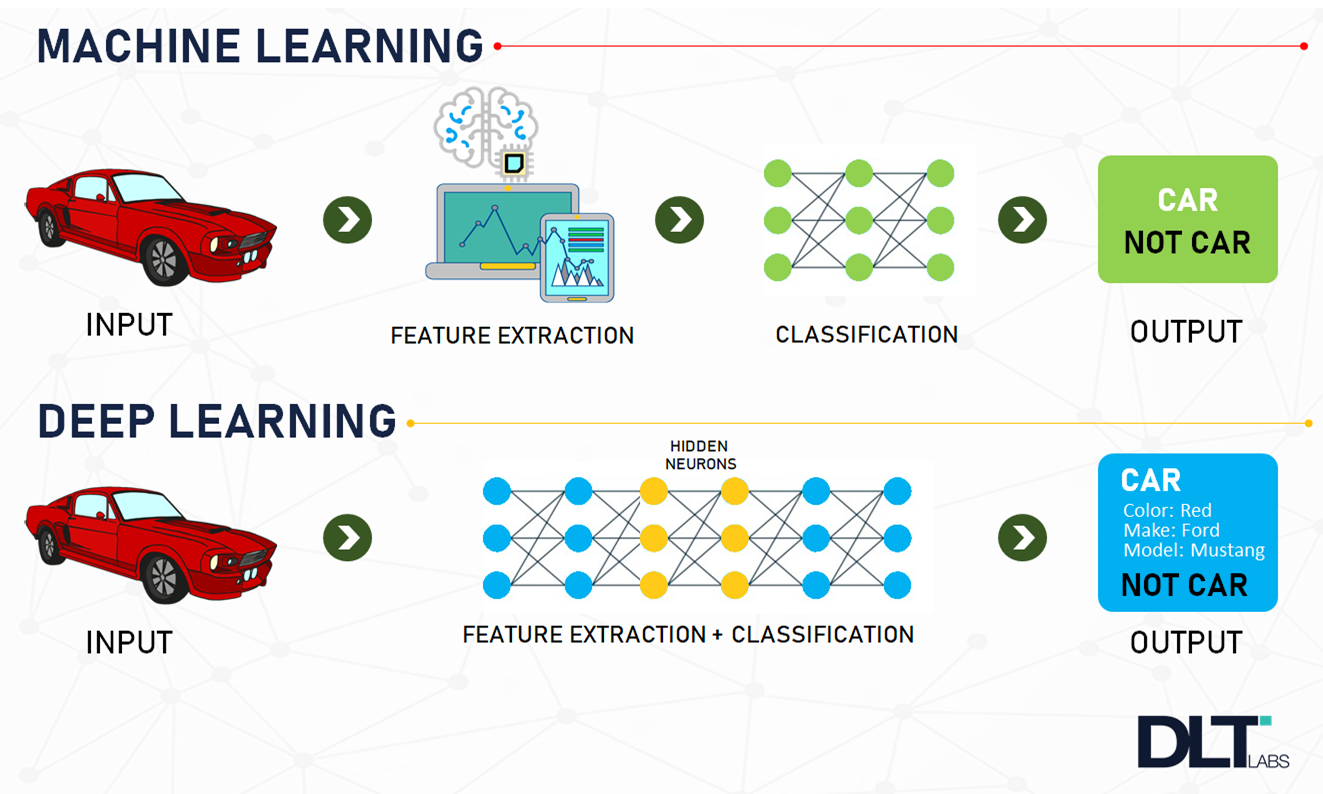

Deep learning is a subset of machine learning, which is essentially a neural network with three or more layers. These neural networks attempt to simulate the behavior of the human brain—albeit far from matching its ability—allowing it to “learn” from large amounts of data. While a neural network with a single layer can still make approximate predictions, additional hidden layers can help to optimize and refine for accuracy. Deep learning attempts to mimic the human brain—albeit far from matching its ability—enabling systems to cluster data and make predictions with incredible accuracy.

Combining Deep Learning with Insurance

Earlier, the insurance industry worked around legacy systems, having bookkeeping and conventional software for documentation. The legacy systems, however, failed to provide optimized outcomes when large chunks of data were poured into the industry, much of what we see today. With the advent of new and advanced technologies, various sectors, including the insurance industry, have begun seeing path-breaking innovation. The insurance industry collects and generates a large volume of data on a daily basis, including a customer’s health records, sensor data from vehicles, confidential legal papers, to name a few. The data, if analyzed thoroughly, gives actionable insights that the insurance industry can use to improve its services. Deep learning comes with neural networks that are capable of analyzing swarms of data and learning from it. Deep learning in insurance not only enhances customer experience but also helps the industry detect fraudulent activities.

What Are the Benefits of Deep learning in Insurance?

Gone are the days when we had to meet an insurance agent in person to buy an insurance cover for ourselves or our prized possessions. The whole process of setting up an insurance account was stressful back then.

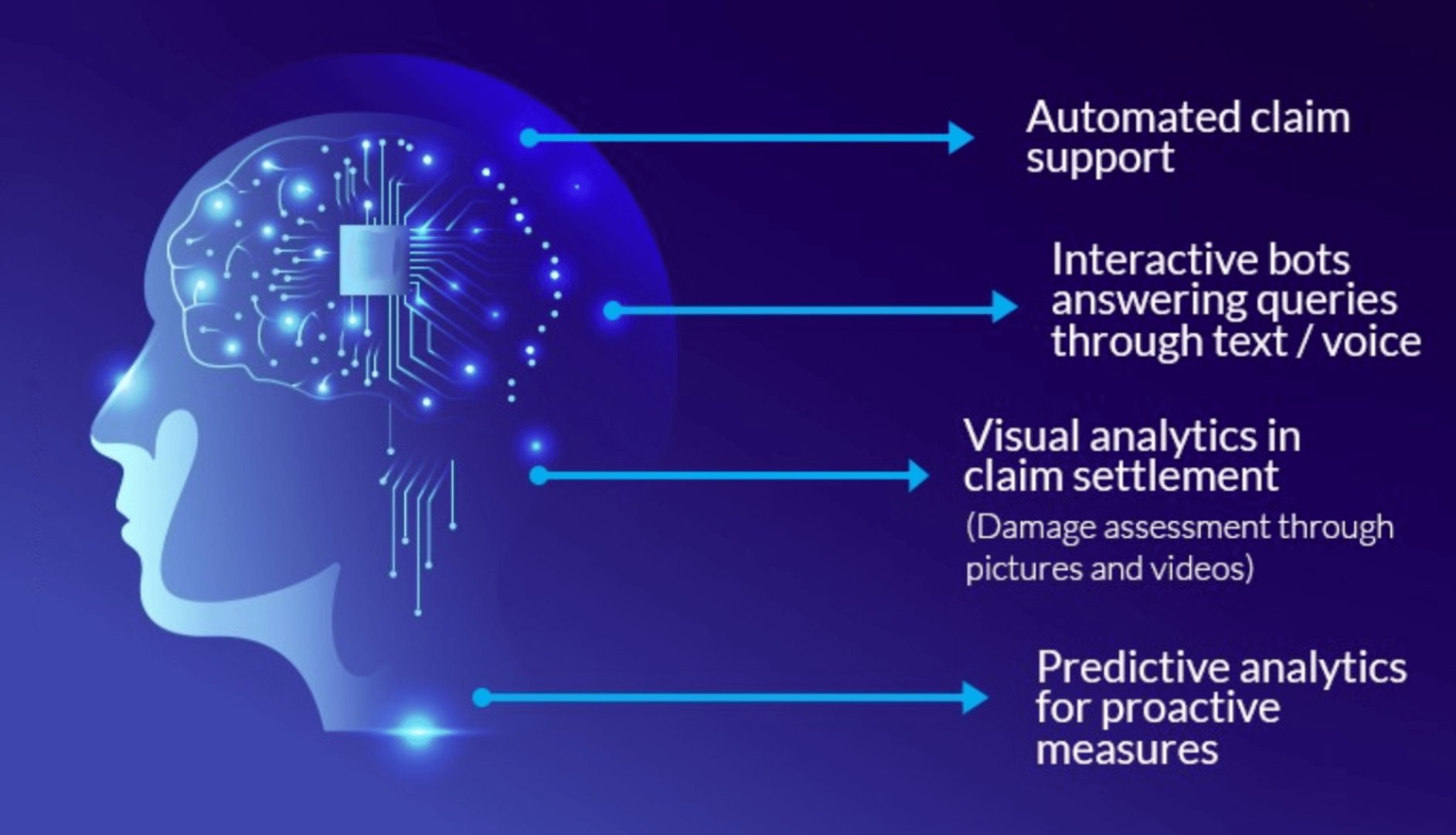

However, today customers expect to avail a service with minimum hassle and maximum support. Deep learning is helping fulfill this expectation to a large extent. And no doubt, the insurance industry is already benefiting from the incredible applications of deep learning. For instance, chatbots are helping the industry offer customers 24/7 assistance without getting tired. But, it’s not just about applications like chatbots, that are already in use. Deep learning applications are about to revolutionize the insurance sector like no one ever imagined.

By integrating IoT and deep learning, the insurance industry is reaching an altogether different level of sophistication. One such jaw-dropping innovation that will blow your mind is this U.S. based insurance solutions provider that uses deep learning and IoT to identify hail hits and missing shingles for roofs. With the help of drones, deep learning, and IoT, the solution makes informed decisions for customers on insurance claims, management, and roof inspection.

What Are the Use Cases of Deep Learning in Insurance?

Deep learning has several uses cases in the insurance industry including:

1. Property analysis

2. Facial recognition

3. Automated claim support

4. Personalized offers

5. Visual analytics in claim settlement

6. Interactive bots answering queries

6. Predictive analytics

7. Documents verification

8. Pricing/Actuarial analysis

Will Autonomous Cars Kill the Insurance Industry?

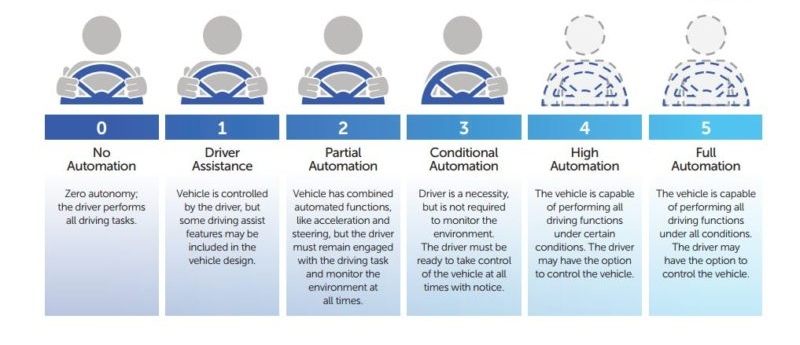

The 5 Levels of Automation

There is a common concern that autonomous cars will burn the car insurance industry in the future. However, the fact is that no matter what level of precision a technology scales, humans will always prefer prevention over cure. Absolute reliance on technology, without any precautions, does not come naturally to most of us, at least for now. Besides, deep learning is yet to go a long way before we hand over the reins completely. For instance, news like that of an “Uber self-driving car kills a pedestrian in the first fatal autonomous crash” cannot be ignored entirely.

So, even though deep learning technology will offer automated services, people will opt for an extra measure of security, meaning that the insurance industry will never burn out. Top brands like Google, Mercedes, and Volvo, have insured their robocars. They are also ready to accept liabilities if their technology is at fault. So, deep learning in insurance is only going to benefit the sector and nothing else.