Venture investment into cryptocurrency and blockchain companies has gone through the roof in 2021, topping $26 billion this year—a 477 percent increase over the $4.5 billion invested in the sector in all of 2020.

With that in mind, Crunchbase News spoke with Shan Aggarwal, who leads Coinbase’s venture and acquisition strategy, and has been investing for the firm since 2018.

Coinbase, founded in 2012, built a platform for users to buy, sell and manage crypto. It also supports a merchant network to accept cryptocurrencies as a form of payment. The company went public in April at a valuation of $86 billion, but as of Dec. 16, the stock is trading below that amount at $55.6 billion. Coinbase states that it has 73 million verified users and 10,000 institutions using its platform.

Search less. Close more.

Grow your revenue with all-in-one prospecting solutions powered by the leader in private-company data.

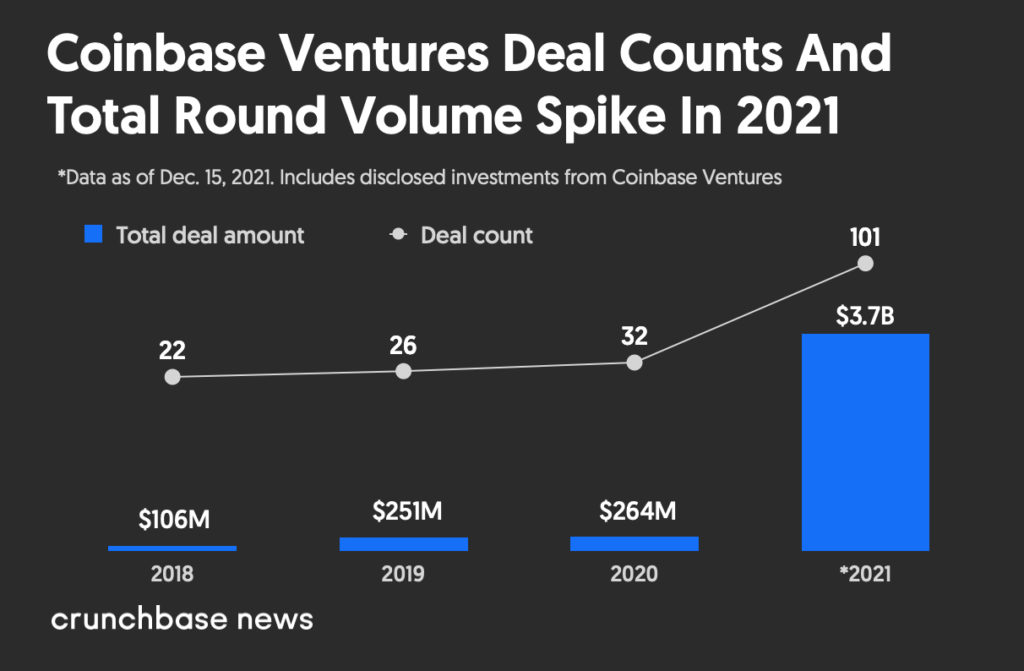

As global investment in the crypto sector has grown, so have Coinbase Ventures’ investments. The firm has made more than 100 investments this year, participating in deals worth $3.7 billion, Crunchbase data shows. Last quarter, it invested on average every 1.8 days, according to Aggarwal.

That’s a big leap forward from where the industry was just four years ago.

“It was really difficult for entrepreneurs starting businesses in the crypto space to get funding, because there was a little bit of a sheen over the crypto ecosystem with reports about fraud and cybersecurity,” said Aggarwal, who serves as Coinbase’s head of corporate development and ventures.

Although it was 2018, it felt like the early days of the internet. “We’re sitting here meeting with all these entrepreneurs and we have access to all of these amazing companies. If we believe in the long-term potential of crypto, these companies are going to be extremely consequential,” he said.

Future $20 trillion asset class

Coinbase Ventures’ mandate was to support the leading entrepreneurs and projects that would drive the crypto ecosystem forward. “If the crypto ecosystem goes from a $3 trillion asset class today, to a $10 trillion, $20 trillion asset class in the future,” Aggarwal said, “that’s going to benefit the entrepreneurs that are helping expand that, it’s going to benefit Coinbase and it’s going to help us accelerate our mission of creating more economic freedom in the world.”

The team was focused on creating the easiest way to bootstrap and build an investing capability. Coinbase Ventures started investing at pre-seed and seed off the balance sheet of Coinbase. The team working on ventures four years ago all had other day-to-day jobs.

“The benefit of having the support of Brian (Armstrong), Emilie (Choi), Alesia (Haas) and our executive team, is where we see amazing opportunities to invest in entrepreneurs and projects, they believe that we should pursue those opportunities, and give us a lot of flexibility to do so,” he said.

The firm has since evolved its investing focus. Today, around seven team members meet companies, do due diligence and lead investments.

Coinbase Ventures has a core early-stage investment practice with investments from $100,000 on the low end up to $3 million. Its intent is to be part of the first institutional round.

“We want to see more company formation, because we think that more companies in the space, experimenting with various business models on these crypto protocols, is going to accelerate innovation overall,” Aggarwal said.

The firm has seen the crypto ecosystem grow particularly quickly in the past year, he said: “We have opportunities to invest a larger amount in companies that we partner with. We call those strategic investments.”

Crunchbase data also bears this out. In 2021, Coinbase’s investments in crypto- and blockchain-oriented startups grew to 101 with a total of $3.7 billion raised by the companies in those rounds. The firm does not typically lead, per Crunchbase data.

In the third quarter, the firm made on average a new investment every 1.8 days, according to Aggarwal.

The majority of companies in Coinbase’s portfolio are from North America, followed by Asia and Europe.

Coinbase partners

Coinbase has also acquired 20 companies to date, according to Crunchbase data. One of its acquisitions is Bison Trails, an early investment that grew into a partnership for institutional clients before it became clear the company fit into Coinbase’s product strategy for building infrastructure for the ecosystem.

The company has also partnered with CoinTracker, which provides tax preparation services for helping customers make sense of their tax liabilities.

Fellow active investors

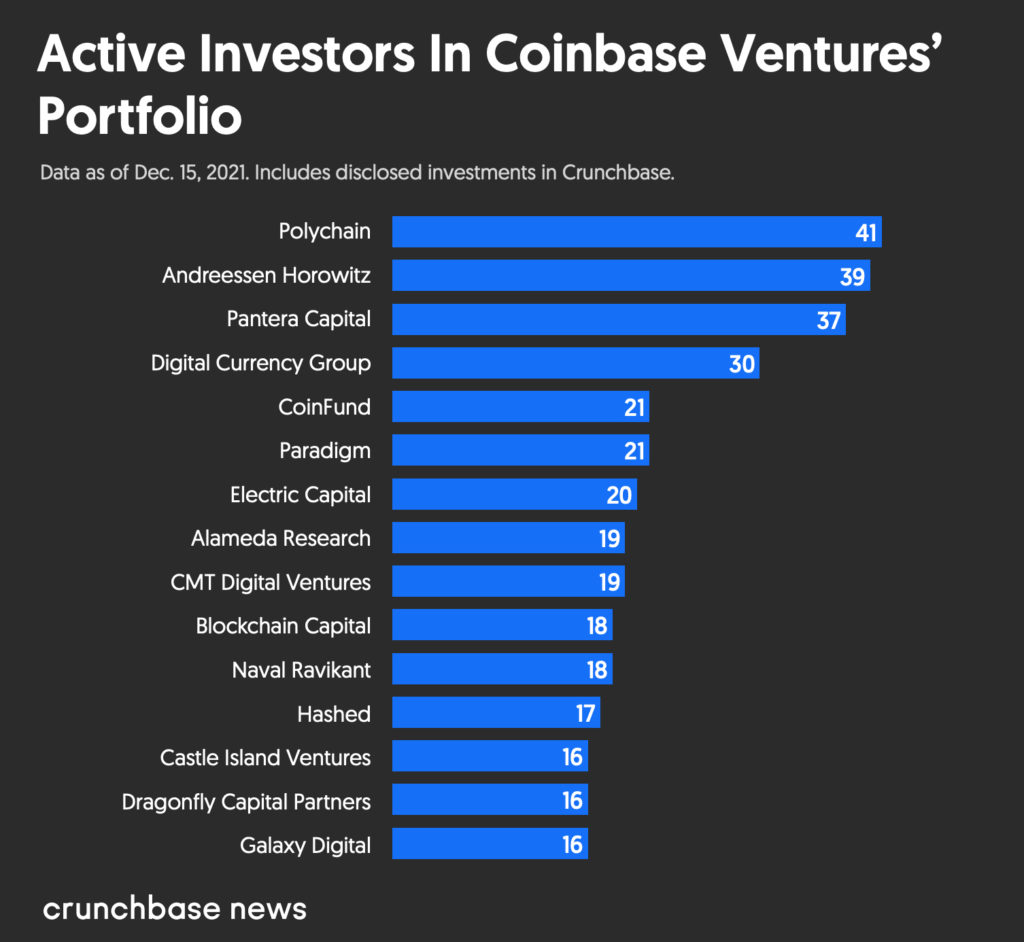

The most active fellow investors in the Coinbase portfolio of companies are Silicon Valley-based firms Polychain, an investor in cryptocurrency protocols; Andreessen Horowitz, which announced its first crypto fund in 2018; and Pantera Capital, an investor in blockchain and digital currencies. Both Polychain and Andreessen are also investors in Coinbase itself, with Andreessen leading the Series B in 2013.

Outside of Andreessen Horowitz, which does have a dedicated crypto fund, these active investors invest primarily in digital currencies, assets and blockchain technologies.

The vast majority of those active investors in Coinbase’s portfolio are U.S.-based funds, with the exceptions of Hong Kong-based Alameda Research and South Korea’s Hashed. Angel investor Naval Ravikant ties in the 10th spot as one of the most active investors in Coinbase’s portfolio, alongside San Francisco-based Blockchain Capital.

Crypto community

“One of the benefits of having a team of folks that are super passionate about early-stage entrepreneurship and about crypto, is folks have their ears to the ground,” Aggarwal said. “They’re embedded in Discord and in the right communities and so speaking with casual investors, entrepreneurs and developers.”

Aggarwal notes that these communities live in disparate places. “There’s chat that occurs in Discord, there’s discourse that happens on Twitter, some of it happens on Telegram.”

And the code is mostly open-source. “You can leverage the products and the work that other developers in the community have done, and you can build and expand upon it,” he said. “You’re not starting from zero every time. And there’s this really amazing ethos of collaboration that exists in the community where if you’re a five-person team, you can build products that have an impact globally and touch many people.”

Crunchbase Pro queries related to this article

Illustration: Dom Guzman

Stay up to date with recent funding rounds, acquisitions, and more with the Crunchbase Daily.

Looking back at our most-read stories of 2021, it was no surprise that coverage of IPOs and SPACs, emerging new startup hubs, and highly funded…

Tiger Global Management, SoftBank Vision Fund and Insight Partners aren’t traditional venture capital investors, but the three growth equity firms…

You must be logged in to post a comment.